Banks face a real financed emissions reporting problem today. They’re under growing regulatory pressure to report on financed emissions from their SME clients. But the catch is that most small and mid-sized businesses don’t have the time, tools, or expertise to track their emissions, let alone produce compliant ESG reporting that meets regulatory standards.

Relying on proxy averages is no longer enough. Banks need accurate, financed emissions data to stay ahead of compliance, avoid disclosure risks, spot financing opportunities, and build trust with regulators and the public.

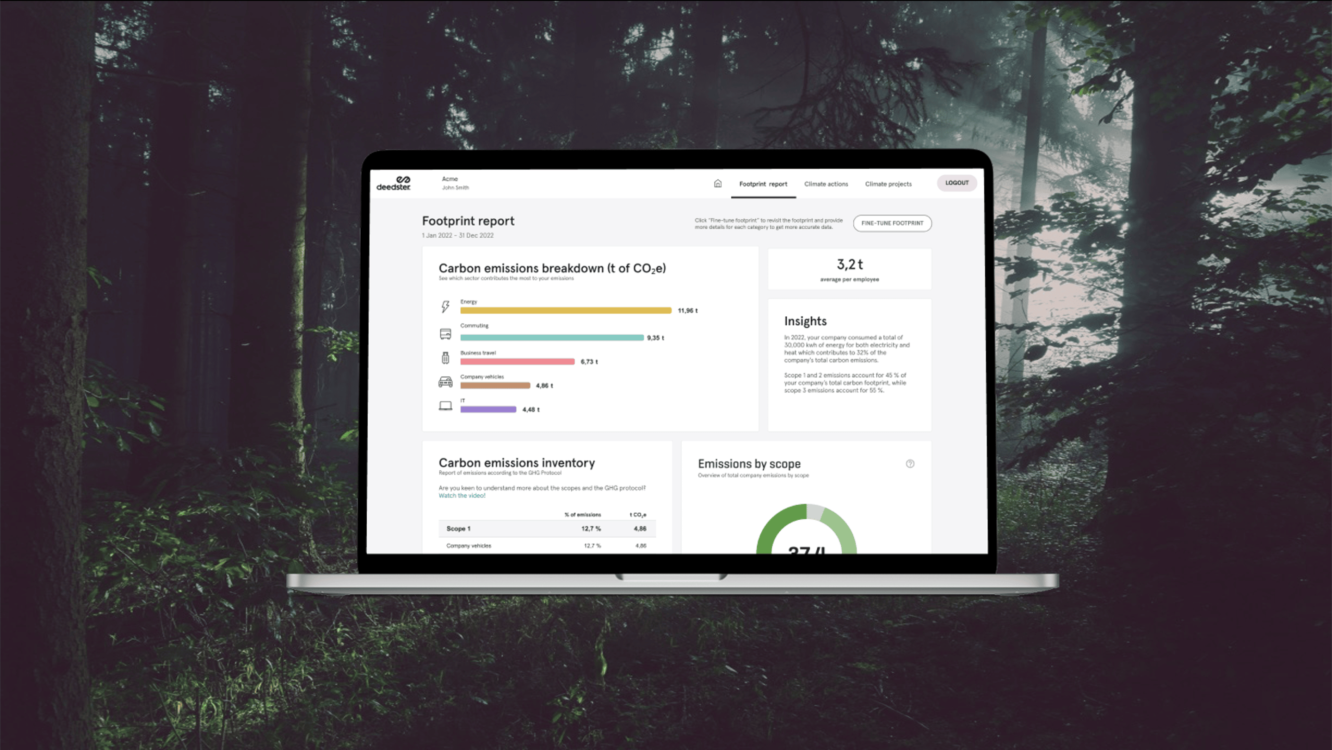

Enter the Financed Emissions Platform.

Built to bridge the gap between ESG reporting obligations and real-world SME capacity, the platform is designed to collect data and transform it into insight, action, and accountability. It solves the financed emissions reporting problem.

Let’s break it down.

1. Seamless integration for real-world use

The tool simply embeds directly into a bank’s existing web environment via a simple API. Forget the separate logins and clunky transitions.

For the SME it appears as just another section of their banking interface, but one that asks the right questions and offers guidance along the way. It translates complex sustainability standards into plain, actionable steps. Think of it as a digital sustainability advisor, scaled for everyone.

2. ESG data that actually says something

Traditional ESG reports often rely on broad assumptions and outdated proxies. The Financed Emissions Platform flips the script with transaction-based emissions data – giving banks and businesses a living, accurate view of their impact.

This isn’t just about how much carbon a company emits. It’s about understanding why it happens, where the hotspots are, and how to move toward real emissions reductions. For banks this means better insight into ESG risks across their corporate and SME portfolios, and the ability to report on them with confidence.

3. From reporting to transition planning

The Financed Emissions Platform helps both banks and SMEs create credible transition plans based on activity-level data. That means identifying emissions drivers, estimating financing needs, and mapping out practical steps to meet climate targets.

In turn, banks gain a powerful edge: the ability to identify financing opportunities. For SMEs, this unlocks new avenues of climate-linked financing and strategic support.

4. A new kind of client engagement

Instead of chasing ESG reports at year-end, the Financed Emissions Portal creates an ongoing touchpoint between banks and their clients. This enables real-time insights, ongoing support, and collaboration on climate strategies.

It’s more than operational efficiency. It’s a fundamental shift in how banks demonstrate their climate commitments. In short: less talk, more product-driven action.

A tool for our times

The platform revolutionizes sustainable finance. It solves the SME carbon reporting problem with precision, practicality, and foresight by bringing transaction-based financed emissions data to the front lines of climate action.

With regulatory pressure from CSRD and EBA, proxy estimates won’t cut it. This tool helps banks collect real data from their SME and corporate clients. It reduces risks, supports compliance, and transforms ESG reporting from a burden into a business advantage.

This is what the future of sustainable finance looks like: transparent, data-driven, and collaborative.

Want to learn more about the solution? Reach out to the Deedster team:

Niclas Persson, CEO

Monika Martinsson, Head of Growth

Pascal Wanner, Business Development Manager

Related posts:

Share this Post