Most of us don’t think about what our banks do with our savings. But banks don’t just store our funds – they use them. To lend. To invest. To build. And these investments have environmental consequences. Because the emissions tied to what banks finance – be they factories, freight companies, or farms – are quietly shaping our planet’s climate trajectory.

These are called financed emissions. And they’re quickly becoming one of the most important climate metrics no one outside the financial world is talking about.

Financed emissions: the hidden footprint of the financial system

When we talk about reducing carbon emissions, we often focus on what individuals can do: switch to renewable electricity, eat a more plant-based diet, fly less. But the carbon footprint of our money – where it’s stored and how it’s used – often has a far larger impact.

For banks, most emissions don’t come from offices or company cars. They come from the companies they finance: the logistics firm moving goods across Europe, the agricultural supplier expanding into new markets, the manufacturer with outdated, energy-intensive machinery.

Most of these businesses are SMEs – small and medium-sized enterprises. They’re the backbone of most economies. They employ people. They drive innovation. Collectively, they contribute to financed emissions on a massive scale. And many of them don’t have the resources or tools to calculate, let alone reduce, their emissions.

This is where banks run into a bit of a dilemma. Multiple legislation say they have to report and reduce financed emissions, but the companies they’re financing often don’t know what their emissions are in the first place.

A data problem with climate-sized consequences

This isn’t just a technicality. Global climate goals depend on the entire economy shifting to net zero, including the smaller players. But tracking emissions is complicated. It requires reliable data, standardized frameworks, and in many cases, expertise that most SMEs simply don’t have.

So, what happens? The emissions go unreported. Banks make assumptions. And they lose opportunities for real, data-driven change.

Without clear visibility into financed emissions from SMEs, banks risk failing to meet regulatory targets and miss opportunities to shift capital toward more sustainable business models.

Financed emissions tools can bring SMEs into the fold

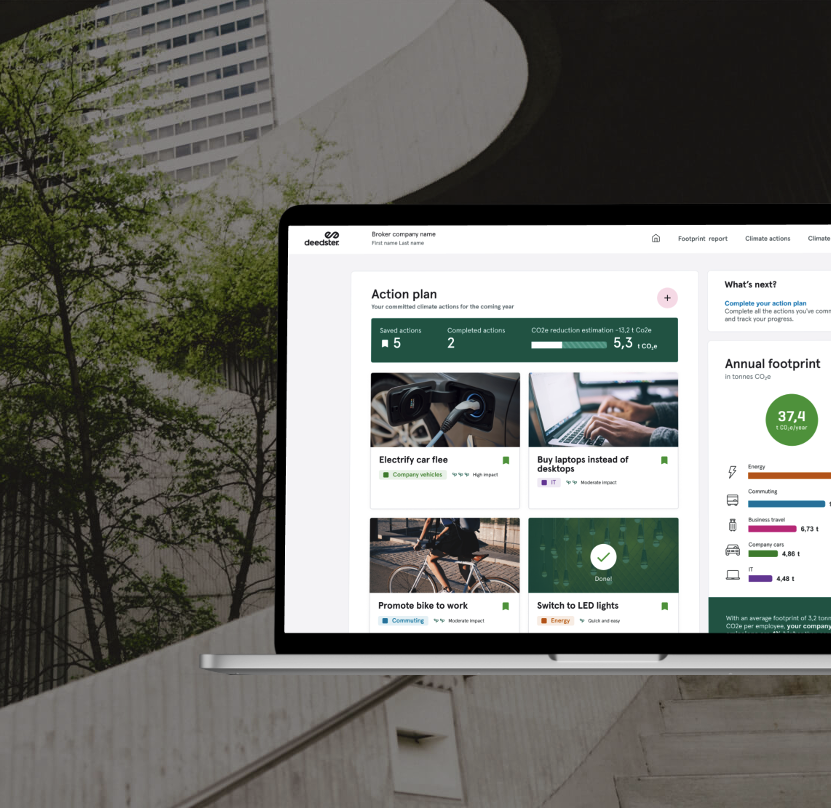

In response, a new wave of digital platforms are emerging to close the gap. Instead of forcing SMEs to figure things out on their own or hire expensive consultants, these tools guide them through calculating and managing their financed emissions.

For banks, this means better data, smarter risk assessments, and transition plans that align with sustainability goals. For businesses, it lowers the barrier to entering the green economy.

But more importantly, it replaces guesswork with informed, strategic climate action

Why this matters – beyond banking

You don’t need to work in finance to understand the stakes. As the financial sector reorients itself around climate risk, the ability to account for financed emissions will shape which businesses thrive, which fade, and which innovations get the financial support they need.

If banks continue to operate in the dark, without accurate data from the small businesses they fund, they risk undermining the very climate commitments they’ve made.

But if they get it right, and if tools that help SMEs calculate their emissions scale, we could see a meaningful shift: capital flowing to businesses that are prepared for the low-carbon future, rather than those clinging to the past.

In the end, it’s about aligning incentives. Making it easier for small businesses to track their emissions and making it harder for institutions to ignore them.

Because the net-zero transition won’t be driven by individuals alone. It’ll be shaped by systems. And those systems, including finance, need to be smarter, faster, and far more transparent than they are today.

To learn more about how banks can better support the SMEs they finance, don’t hesitate to reach out to:

Niclas Persson, CEO at Deedster

Monika Martinsson, Chief Growth Officer at Deedster

Pascal Wanner, Business Development Manager at Deedster

Related posts:

Share this Post