Banks are navigating a tricky challenge when it comes to financed emissions reporting: how to accurately account for the carbon footprint of their corporate clients, especially small and medium-sized enterprises (SMEs). The current answer, for most, has been proxies. Industry averages, rough estimates and annual reports. It’s better than nothing …

How banks can solve the ESG and financed emissions reporting problem for their SMEs

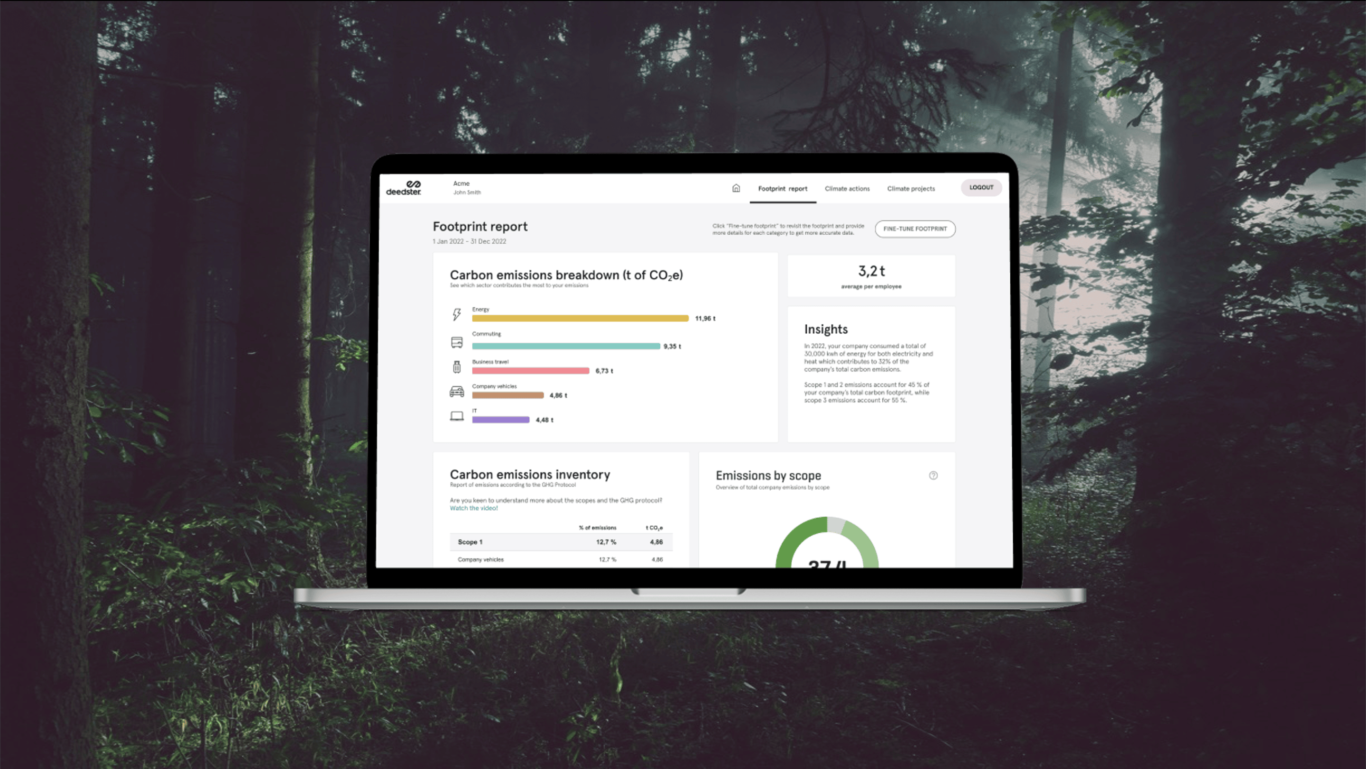

Banks face a real financed emissions reporting problem today. They’re under growing regulatory pressure to report on financed emissions from their SME clients. But the catch is that most small and mid-sized businesses don’t have the time, tools, or expertise to track their emissions, let alone produce compliant ESG reporting …

Deedster wins Mastercard Lighthouse MASSIV Spring 2025 – Recognized for climate innovation

Tallinn, Estonia | May 22, 2025 – Swedish impact tech company Deedster has been named the Winner of the Mastercard Lighthouse MASSIV Spring 2025 program, a leading Nordic-Baltic accelerator for startups tackling global challenges. Out of hundreds of incredible startups across the Nordics and Baltics, Deedster was awarded for its …

Scaling Climate Impact with Mastercard Lighthouse MASSIV

Deedster is on a mission to scale climate action and accelerate the climate transition by turning everyday financial data into real sustainability impact. As part of the Mastercard Lighthouse MASSIV program, we’re scaling our tools and growing a network of bold collaborators across the financial industry. In this short video, …