Need to find a way to track your corporate clients’ emissions? It’s a situation many banks and financial institutions find themselves in. There’s regulatory pressure to account for the greenhouse gas emissions tied to lending and investment activities, aka financed emissions. An effective RFP to measure financed emissions is essential …

Why SME transactions data are key to financed emissions

Banks are navigating a tricky challenge when it comes to financed emissions reporting: how to accurately account for the carbon footprint of their corporate clients, especially small and medium-sized enterprises (SMEs). The current answer, for most, has been proxies. Industry averages, rough estimates and annual reports. It’s better than nothing …

How banks can solve the ESG and financed emissions reporting problem for their SMEs

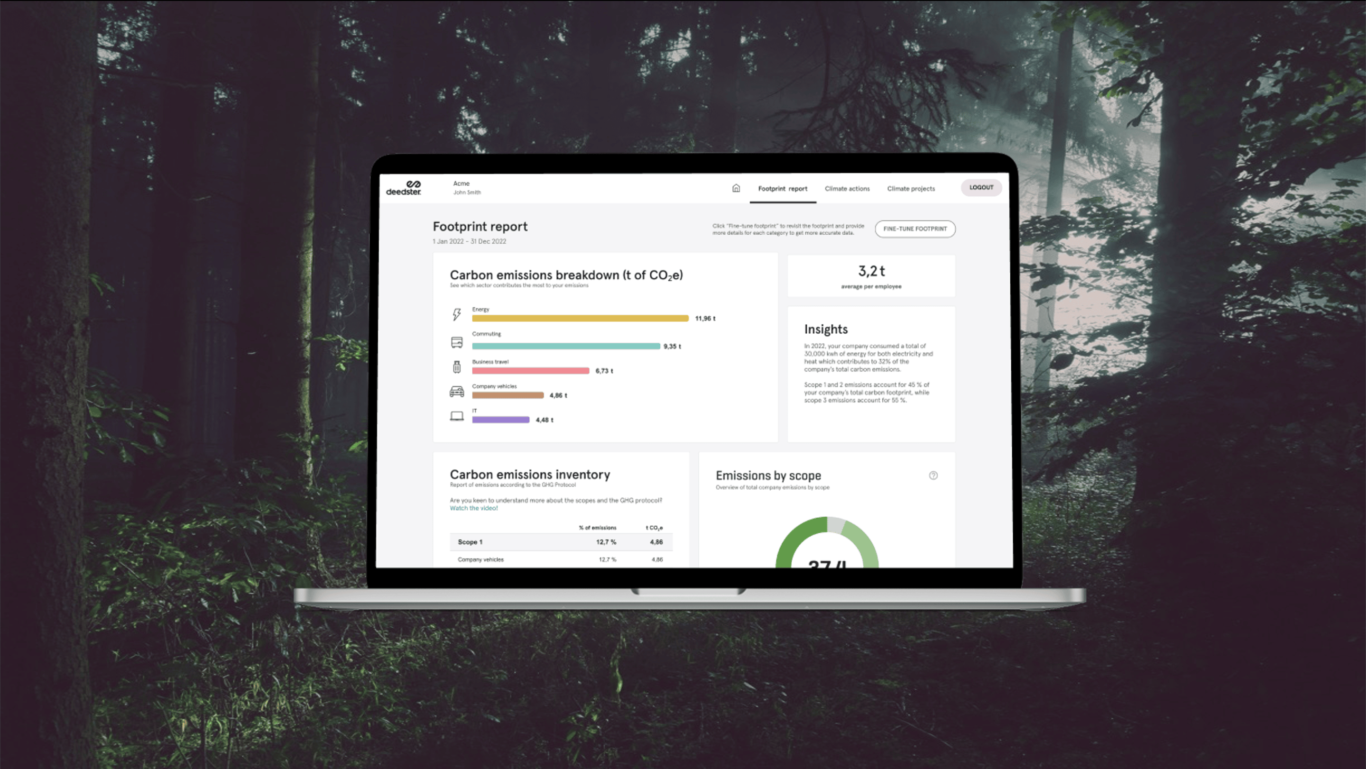

Banks face a real financed emissions reporting problem today. They’re under growing regulatory pressure to report on financed emissions from their SME clients. But the catch is that most small and mid-sized businesses don’t have the time, tools, or expertise to track their emissions, let alone produce compliant ESG reporting …

The Carbon Behind Your Cash: Why banks are under pressure to report on financed emissions

Most of us don’t think about what our banks do with our savings. But banks don’t just store our funds – they use them. To lend. To invest. To build. And these investments have environmental consequences. Because the emissions tied to what banks finance – be they factories, freight companies, …